Forecasts predict change of pace for Sydney property market

This article is sponsored by Quantum Group.

SYDNEY’S property value has climbed to an all time high, induced by a rising population growth and foreign investment, that has helped to boost high-rise development offerings, yet hindered first home owners’ purchasing abilities creating uncertainty in the market.

Although, forecasts predict a degree of stabilisation on the horizon following the State Government’s major changes to urban density reflected in Sydney’s local environmental plans (LEPS).

LEPS has recently been formulated to increase housing supply, improve zoning and economic feasibility, particularly for Sydney’s first home owners as foreign investors have essentially pushed them out of the playing field.

Peter Gribble, founder and director of Quantum Group is currently developing two projects in Sutherland; the Linden and the Adelong, and he believes Australia’s growing population and changes to urban density regulations is majorly impacting the construction industry and ultimately supply and demand.

“With a massive population surge and forecast for the next 10 to 20 years we’re moving to a more denser city – the concept of apartments are becoming much more of a reality,” Mr Gribble said.

“These changes to the property market have prompted APRA and the Reserve Bank to curtail people’s ability to borrow, increasing the probability of interest rates dropping.”

“According to the ABS, construction has slowed down 12 per cent, due to banks tightening development funding,” he said.

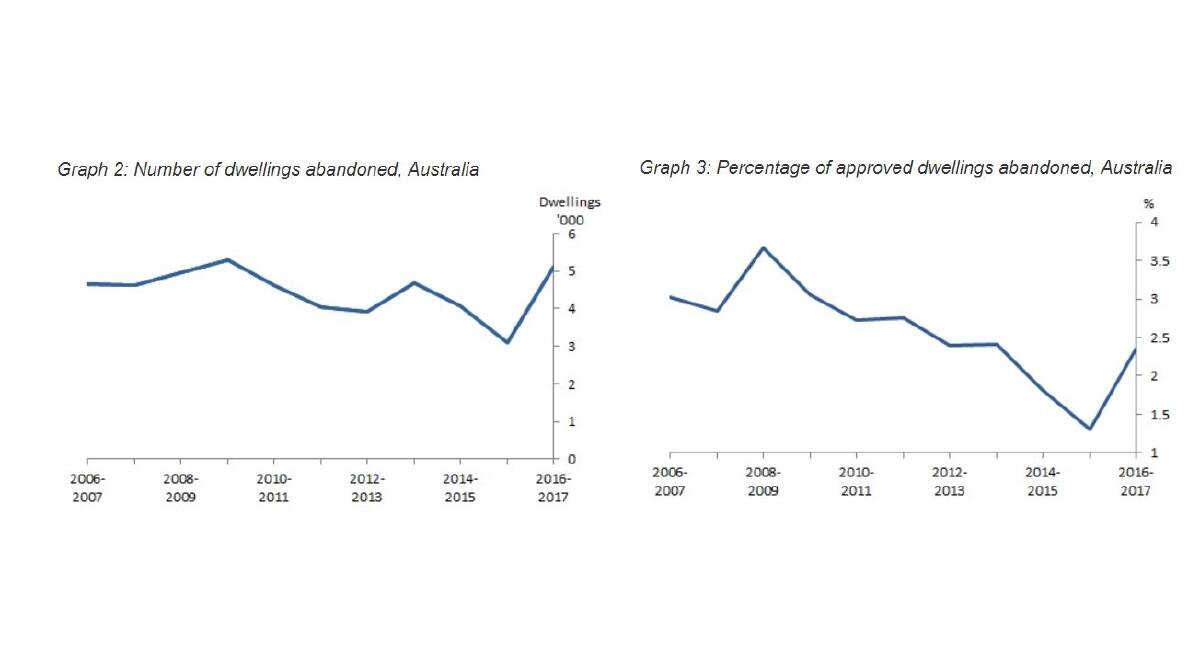

The increased risk that projects will not proceed to commencement (i.e. are abandoned), will significantly contribute to future building activity.

“With construction and development approvals pulling back, there’s an indication that there’s going to be a reduction in supply eventually, property prices are going to stabilise and it’s very likely interest rates might drop post Christmas.”

“Unemployment has also dropped 0.1 points to 5.5 per cent – people are feeling comfortable and Sydney is going to remain stable but drop back to a single digit growth rate.”

Whilst these forecasts lend for optimism there is an underlying sense of fear transpiring, as a growing number of parents seek to secure homes for their children.

Mr Gribble said they’re seeing parents coming in and wanting to buy three one bedder apartments because there’s a “fear factor” of whether the younger demographic will have the ability to enter the market.

Parents are the fifth largest bank in Australia, according to financial comparison website, Mozo.

- Mr Peter Gribble

“Loans from parents to their kids is giving an indication that the rush from offshore buyers has pulled back. Houses aren’t available, nor an option for first home owner buyers.”

Mr Gribble said houses are just not available and are outside the game for first home owners.

“They’re targeting one bedroom apartments but there’s an undersupply of this and two to three bedrooms around $700,000 are not as useful for first home owner buyers,” Mr Gribble said.

This article is sponsored by Quantum Group.